Don’t gamble on spring flooding

Feb. 22, 2021

That cold snap we just finished made it feel as if the temperature would hover around zero forever, but the snow and ice will start melting before we know it. That melting snow is one of the first signs of spring, prompted by warm sunshine and temperatures well above freezing.

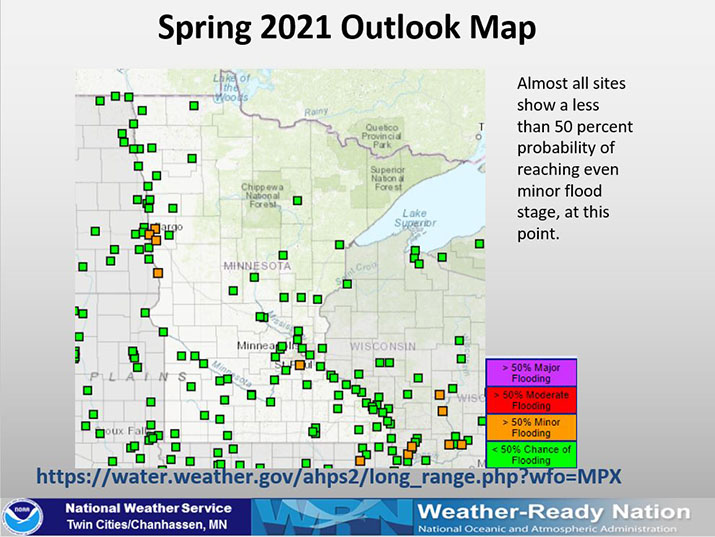

But melting snow can bring flooding with it, and certain other factors can make it worse. For example, soil that is deeply frozen or even just saturated can lead to greater runoff. And spring precipitation – which is often the biggest wild card in predicting spring flooding – can profoundly affect flood intensity. Right now, the Twin Cities National Weather Service believes those factors point to a decreased threat of flooding this spring, but one or two significant snowstorms or heavy rains could change all that.

In the springs of 2019 and 2020, we had what meteorologists call an “ideal melt”: Days warm enough to melt the snow slowly, nights cool enough to stop the melting, and no additional precipitation. But we can’t be sure this year will be the same – and springtime nearly always brings at least some minor flooding to vulnerable places. So it’s important to be prepared with something other than hope.

If hope won’t keep you covered, what will? Flood insurance. Your regular home insurance policy doesn’t cover flooding – it may not even cover water or sewer backups. But you can definitely buy a flood insurance policy, and you don’t even have to live in a flood plain to do so. If your community participates in the National Flood Insurance Program (and 95 percent of Minnesota communities do), you qualify. And at an average cost of $500 per year, which is $42 per month, peace of mind is pretty affordable.

If your home floods and you don’t have flood insurance, you’ll end up paying out of pocket or having to take out a loan to repair the damage. Yes, sometimes there are Federal Emergency Management Agency grants, but those are relatively rare, and they tend to only provide about $5,000 per home. Compare that to 2017’s average flood claim of $90,000, and you can see that flood insurance is the way to go. The timing is important, too: It takes 30 days for you to be covered by your flood and sewer/water backup insurance policies, so don’t wait until the waters are rising to buy a policy. That’s why you need to do it now.

Floods are the most common and costly natural disasters in the U.S., so don’t let one take you by surprise. Check our spring flooding webpage often – it will be updated with daily reports should our waters rise this spring. And prepare yourself and your family for spring flooding by taking out a flood insurance policy, before it’s too late.